Financial Impact

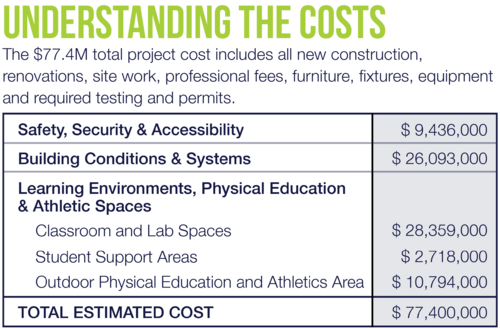

Nicolet Union High School District residents will have the opportunity to vote on one referendum question that requests permission for the district to borrow funds (issue debt) in an amount not-to-exceed $77,400,000 to address three key areas of facility needs including: safety, security, and accessibility; building conditions and systems; and learning environments, physical education, and outdoor athletic areas.

If approved by voters, the estimated tax increase over the current level for each $100,000 of fair market property value would be $111 per year ($9.25 per month) for approximately 21 years.

The District’s financing plan utilizes 20 year borrowings phased over a 2-year period with a planning interest rate of 3.50% for a total repayment period of 21 years. Even with the recent increase, interest rates are still at historically low levels. If interest rates remain low after the referendum, the District would be able to significantly reduce the interest cost related to the borrowings and could reduce the estimated tax impact. Interest cost would be reduced by over $4.5 million with each interest rate reduction of 0.50%.

Estimated mill rate impact is based on the 2021 Equalized Valuation (TID-OUT) of $4,446,903,700 with annual growth of 1.00%. Nicolet’s property value growth for the last three years were: 5.83% in 2019, 0.96% in 2020 and 1.93% in 2021.

The estimated cost represents the maximum increase in the Fund 39 tax (mill) rate for referendum debt payments beginning in the 2022-23 school year.

Use the Tax Calculator link below to determine your estimated tax impact for the referendum debt question.